Following the launch of London Help to Buy scheme, home buyers can now look forward to a promising year ahead. Initiated by the Government, London Help to Buy is an extension of the existing Help to Buy scheme, aimed at helping more Londoners get on the property ladder. The scheme offers buyers in all London boroughs an equity loan of up to 40% (an increase from 20% under the original Help to Buy) when buying their property, effective from 1st February this year.

So, how does the new scheme work?

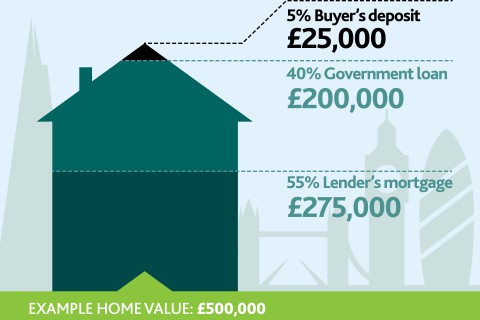

If you are looking to buy your first home or are an existing homeowner looking to move to a London borough with a budget up to £600,000, and have at least a 5% deposit available, you can apply for a Government equity loan for up to 40% of the purchase price. Your mortgage will comprise the remaining amount of the purchase price after the deduction of the cash deposit and the Government loan.

How much can I borrow?

- You can apply for a Government equity loan for up to 40% of the purchase price

- There will be no interest charge on the Government loan for the first five years of owning your property

- There will be a management fee of £1 a month from the date of purchase

- From year six, a fee of 1.75% is payable on the equity loan, which rises annually by RPI (Retail Price Index) inflation plus 1%

Am I eligible for London Help to Buy?

- You must be a first time buyer or a homeowner looking to move

- You cannot own any other property at the time of buying your new home

- You must have a deposit of a minimum of 5% of the full purchase price

What property types are included in the scheme?

- The home you want to buy must be a new build, advertised as Help to Buy by a Help to Buy registered developer

- The home must have a maximum price of £600,000

- The property must be located in a London borough

Will all mortgage lenders offer London Help to Buy?

From 1st of February, Barclays, Lloyds, Nationwide and Leeds Building Society offer London Help to Buy, but the Government expects other lenders to join the scheme in the near future.

Are there any other schemes available for first time buyers?

There are other options of Help to Buy schemes currently available – you can find a brief overview of available options on our Help to Buy section.

For further information on London Help to Buy please visit the Government’s website or if you are ready to take advantage of this scheme find out how to apply.

To find out which new developments offer London Help to Buy, speak to our New Homes experts on 020 7973 2020.