From 6 April 2017, changes will be made to the way buy-to-let landlords are taxed on their rental income. Here, we give a quick overview of the main landlord tax changes and some examples in numbers to show how you may be affected.

Here's a resource for those of you wondering "if I rent my house out, do I pay tax?"

Currently when landlords calculate their taxable rental profits, they can deduct allowable expenses and their mortgage interest payments from their rental income.

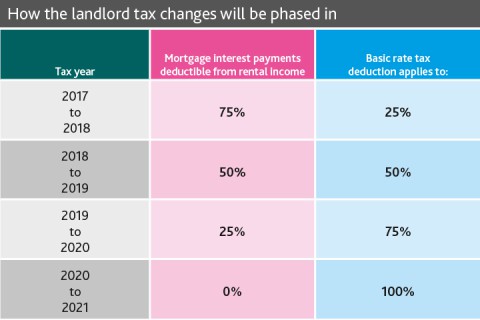

But from April 2017, landlords will be restricted on how much of their mortgage interest payments they can deduct and the total amount will be gradually phased out by 2020/21.

Instead, a tax reduction equal to the basic rate of tax (currently 20%) will be available.

This restriction is gradually being phased in over 4 years from April 2017 as follows:

For more in-depth information on the changes, read our full overview of the landlord tax changes and take a look at the worked examples below to see how your financial situation might change.

Landlord tax changes examples

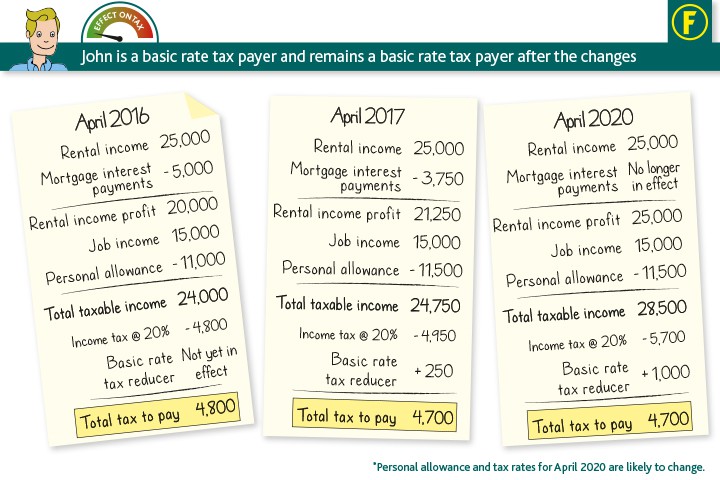

What if I'm a basic rate tax payer?

If John's tax rate remains at 20%, the adjustments to the amount of tax he pays are very minimal. This is because the new 20% tax reducer is equal to his current tax rate. In the 2017/18 tax year he will pay slightly less tax because the personal allowance and tax rates will be amended by the government.

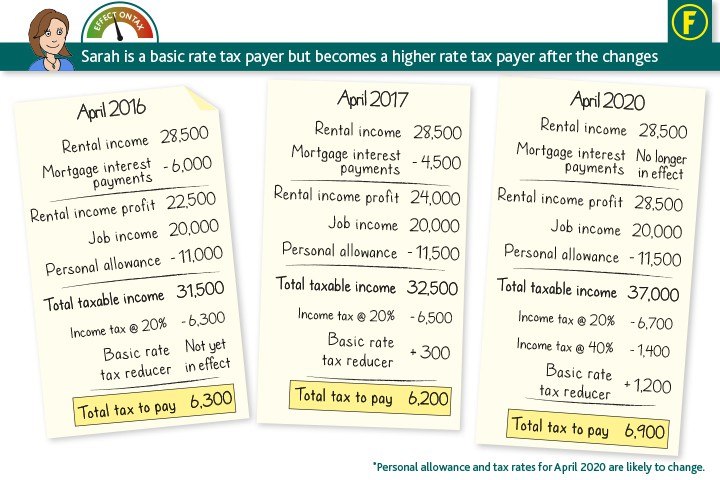

What if I become a higher rate tax payer?

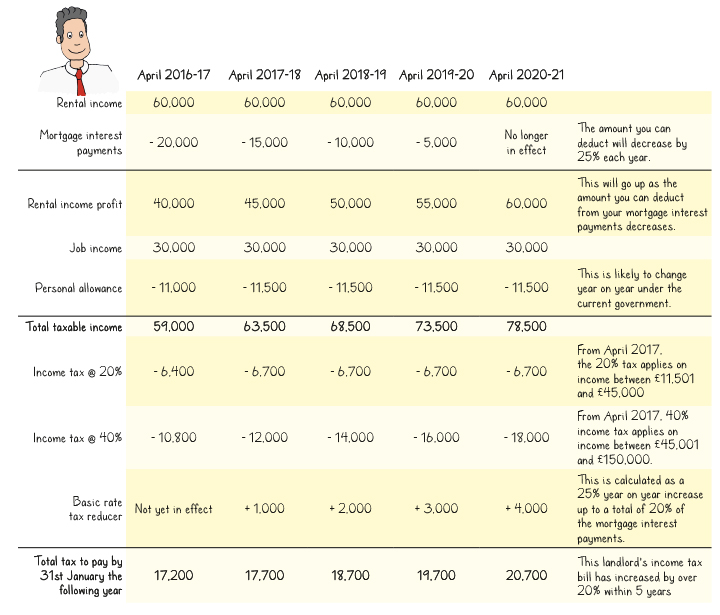

After all the tax changes, Sarah will be pushed into the 40% tax bracket as her income will be above the £45,000 threshold. In the 2017/18 tax year she will pay slightly less tax because the personal allowance and tax rates will be amended by the government.

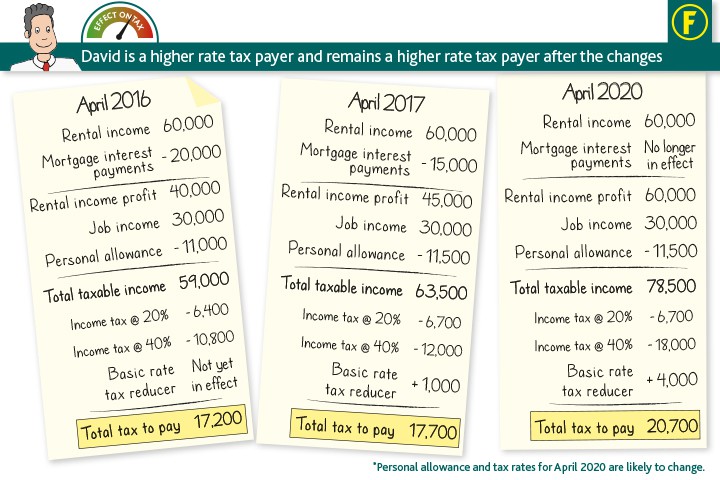

What if I'm a higher rate tax payer?

David's tax rate will remain at 40% after all the changes. But the amount he will pay will increase because he won't be able to claim relief on his mortgage interest payments at his current tax rate.

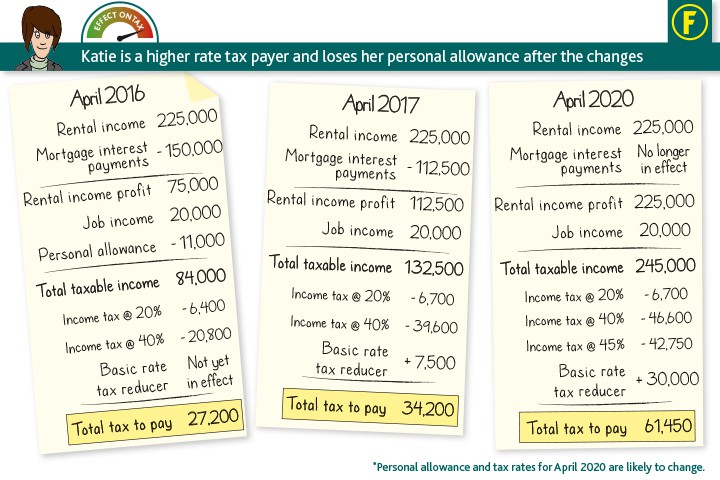

What if I lose my personal allowance?

After the tax changes, Katie's total income will push her above the £150,000 threshold into the additional rate tax band at 45%. She will also lose her personal allowance.

Discover more...

Take a look at our article and infographic on the tax changes for landlords.

*Foxtons have consulted a firm of tax advisers with regards to the content. However, this publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, neither Foxtons, or their tax advisers, accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.