Findings from the most recent Foxtons London Lettings Report suggest that properties in travel Zones 3-6 are the best to invest in.

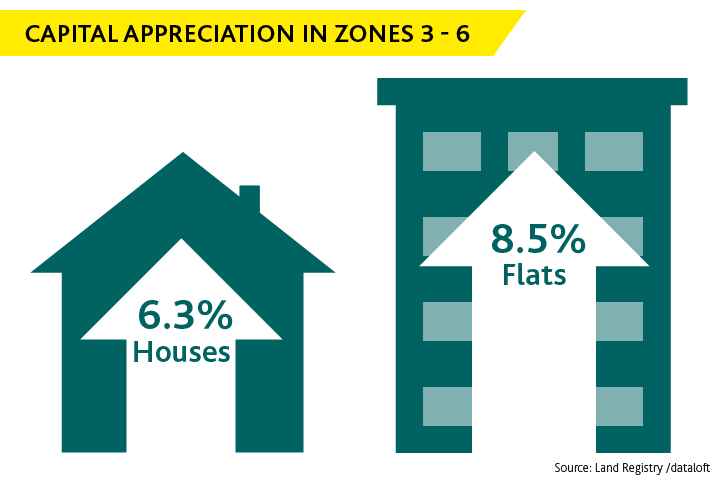

Capital appreciation is highest in Zones 3-6

Comparing year-on-year Land Registry figures on average sales prices, we’re able to see that both flats and houses in Zones 3-6 have experienced the largest growth in capital appreciation.

“Flats are a sound investment”

Looking at the report, it’s great news for flat owners in Zones 3-6, where flats have fared the best of all property types, with capital appreciation of 8.5% year on year.

Houses in outer London follow just behind flats at an average of 6.3%.

And it’s looking positive for property owners in Zone 2 as well, where capital appreciation was 4.3% for flats and 3.9% for houses.

“Buyers are looking further out”

This growth in capital appreciation on properties in outer London is most likely due to the movement of buyers looking further out of central London for more affordable properties.

But it could be to do with the rise in the number of cafes serving avocado brunches, too!

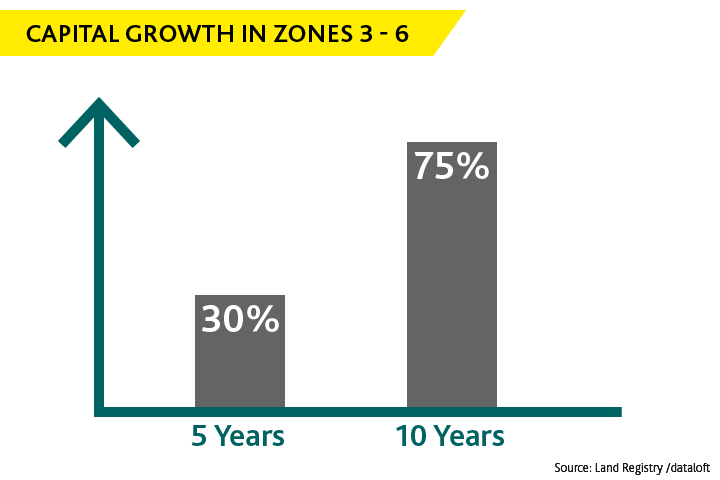

Capital growth at 75% in Zones 3-6

Looking back at house prices over the past five and 10 years, it is clear that property in London is a sound long-term investment, too.

Over the past five years, properties in Zones 3-6 have seen a capital growth of over 30%. And even more impressive is that over the past 10 years, capital growth has reached an average of 75% in Zones 3-6.

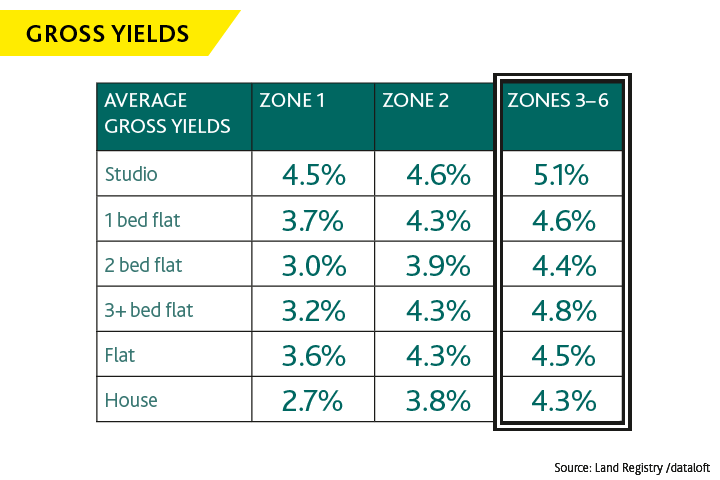

Rental yields are highest by property type in Zones 3-6

If you’re thinking of investing in a rental property in London, our latest figures show that all properties across Zones 1-6 have experienced growth in their gross rental yields in the last quarter.

But again, properties in Zones 3-6 show the most positive figures, with the highest average gross rental yields across the capital.

The highest of all gross yields is studios in Zones 3-6 at 5.1%. And again, it is flats that have fared the best, with gross yields of 4.5% compared to houses at 4.3%.