With so many government Help to Buy schemes, it can be difficult to know what the differences are and which ones you’re eligible for. Here, we guide you through what each London Help to Buy scheme offers.

The biggest misconception is that Help to Buy schemes are only available to first-time buyers. In fact, they’re also available to previous homeowners, as long as they don’t own another property at the time of their Help to Buy purchase. You can’t use the scheme if you’re purchasing a buy-to-let property, or a second home.

Help to Buy: Equity Loan

The Help to Buy equity loan allows first-time buyers and home buyers who do not currently own a property to purchase a newly built home up to the value of £600,000.

How much do I need for a deposit?

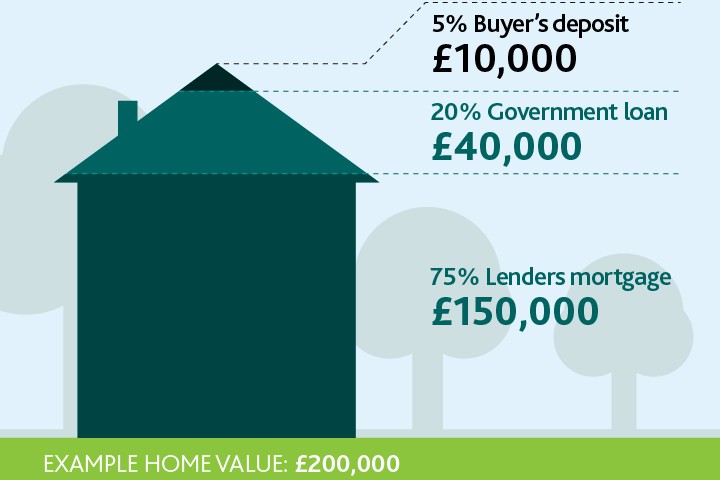

The buyer's deposit contribution needs to be a minimum of 5% of the property’s value, and up to 20% of the value of the property can be borrowed under the scheme. The buyer's deposit and the government-backed loan usually make up 25% of the value of the property, with the remaining 75% borrowed from a mortgage lender.

What mortgage do I need?

- Your mortgage must be at least 25% of the purchase price.

- Your mortgage borrowing must be at a maximum of 4.5x your household or individual income for a Help to Buy purchase.

- You must have a repayment mortgage, not an interest-free mortgage.

How do the repayments work?

The Help to Buy loan is interest free for the first five years. But in the sixth year, you will have to pay interest at a rate of 1.75%. From year 7, the interest fee is set at the rate of inflation plus 1%. You will also have to pay a £1 per month management fee from the date you buy your new home.

If you sell the property before you have paid back the government assisted loan, your repayment needs to match the % contribution that you borrowed. For example, if you borrowed 20%, you will need to pay back 20% of the property’s current market value at the point of sale – not the actual amount you borrowed.

You can make voluntary repayments on the loan before the interest-free five year period is up, but each repayment needs to be a minimum of 10% of the current market value.

London Help to Buy

Like the Help to Buy equity loan, London Help to Buy allows any first-time buyer or previous homeowner access to a Government assisted loan to purchase a newly built property in London.

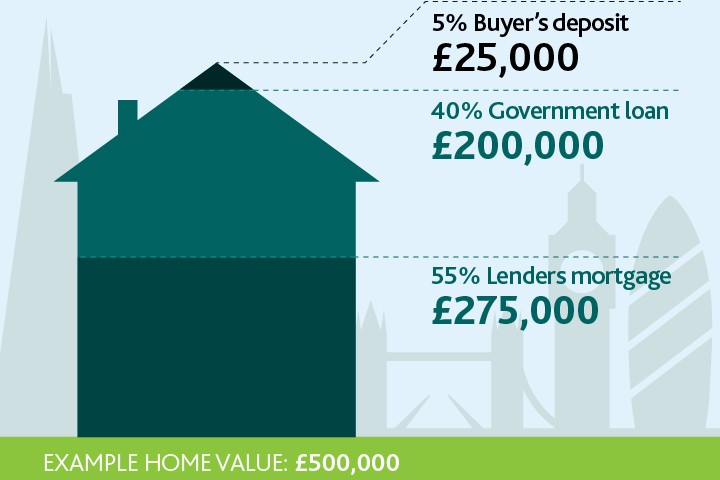

Because London has above average property prices, the amount you can borrow is up to 40% of a property’s value – compared to 20% outside of London.

Usually homebuyers will put down a 5% deposit from their own funds, borrow 40% from the government and 55% from a mortgage lender.

Help to Buy: ISA

The Help to Buy ISA is a first-time buyer saving scheme where the government tops up each individual’s deposit fund by a tax-free 25%. If you sign up for the scheme you will also be able to receive interest on the ISA, which is dependent on the amount each provider gives.

It is only available on properties up to the value of £250,000 outside of London and £450,000 inside the Greater London region.

Who is entitled to a Help to Buy ISA?

While it is only available to first-time buyers, if you are buying with a partner or friend who is also buying a home for the first time, they too can save in a Help to Buy ISA – which means doubling or tripling the bonus, depending on how many people you are buying with.

When do I receive my bonuses?

Before you can claim any part of the bonus, you have to have saved a minimum of £1,600, as the minimum bonus that can be paid is £400, or 25% of the total fund. And the maximum bonus you can claim stands at £3,000.

When you first open a Help to Buy ISA you can deposit £1,200 into the account and from then on you can save up to a maximum of £200 a month. This means you cannot deposit a large lump sum into the ISA and receive the relevant bonus without saving on a month-by-month basis.

While you can only open one Help to Buy ISA in your lifetime, you can move the account between providers to ensure you’re always getting the best interest rate.

Paid on completion

There is one major thing to be aware of with this scheme – you cannot receive your Help to Buy: ISA bonus until you complete on your new home. This means you can’t use the bonus towards the deposit that you pay to the seller when you exchange contracts.

Your solicitor or conveyancer will need to apply for the ISA on your behalf.

Help to Buy: Shared Ownership

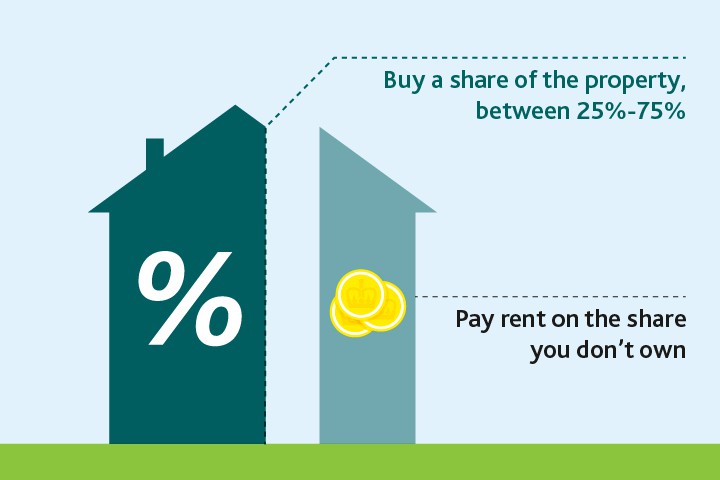

The Help to Buy shared ownership scheme allows first-time buyers, those who have previously owned a property but no longer do so, and those who are an existing shared owner to buy part of a property. They will then pay rent on the other part they don’t own.

The scheme is mainly provided by housing associations and allows buyers to purchase a newly built home, or one that is being resold.

What share of a property can I buy?

Its creation came about as a more affordable way for buyers to be able to purchase a home of their own, allowing people to buy a share from 25% to 75% of a property.

And then staggering ownership in 25% increments when they are able to afford to – but at the current market value, not its original purchase value.

Help to Buy Shared Ownership is available to first-time buyers, previous homeowners, current owners of a Shared Ownership property and those with a maximum household income of £80,000 outside of London and £90,000 within the London boroughs.

What happens when I want to sell?

Buyers need to be aware that when it comes to selling the property, the housing association has the right to buy it back if you own less than 100% of the home. The housing associations are also entitled to find a buyer themselves.

With shared ownership properties, owners will also be responsible for any service and maintenance charges.

Discover more....

Take a look at our new homes for sale, see our guide to buying a new build home, or take a look at our New Year's resolutions for buyers.