Are you thinking of investing in London property or adding to your portfolio this year? The 2023 market has got more to offer than many expected. The Specialist Advisors from our partner mortgage firm, Alexander Hall, have some breaking insight on the market to help you achieve your goals.

Quick facts

Good rates are available. Alexander Hall currently have lenders offering Tracker Rates at around 0.9% above the Bank of England base rate.

Competition is high. Demand is steadily growing in line with last year’s numbers as we head into the summer lettings market peak.

Lenders are adapting. Some lenders are tweaking their products to help Landlords in the current climate.

Is it the right time to apply for a buy-to-let mortgage? Here’s your overview of the current market for Buy-to-Let Investors.

Interest rates have remained a hot topic this year. They began to rise in May 2022 and were swept up in the infamous September Mini Budget, ringing in some dower predictions for 2023. The new year surprised everyone with a bit of stability coming to the financial markets and confidence creeping back into lending. Yet, inflation remains stubbornly in double figures and the Bank of England base rate just reached 5% on 22 June.

So, while forecasts broadly predict that the interest rate will decline toward the end of 2023, and even now mortgages are more competitive than they were last September, we should not expect the historic low rates of recent years.

The market will continue to change in the coming months, and there may be hurdles for Buy to Let investors to find the right mortgage. However if you do, there is an excellent opportunity to provide much needed rental properties ( (read: Lettings takes centre stage).

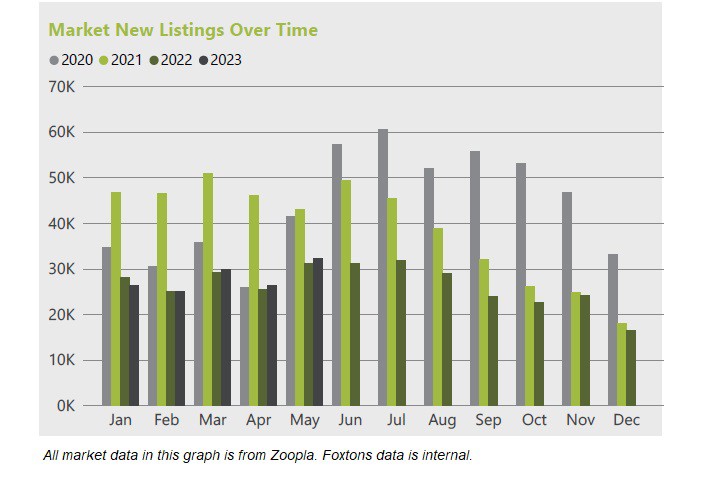

Analysis of demand, showing 2023 levels following right in line with 2022, from our May Lettings Market Report.

Analysis of supply, from the May edition of our monthly Lettings Market Report, which also shows 2023 levels following 2022 trends.

Where is the opportunity?

The Lettings market is expected to grow at a steadier incline through the year, instead of the sharp spikes we saw last year. In line with predictions, we are seeing similar levels of supply and demand year on year, and experienced Renters are starting their search before the typical peak season. So, demand is already strong, and competition is going to get more intense as we head into the summer. At the same time, the sales market has cooled somewhat from the intense highs that sellers enjoyed in early 2022, providing valuable opportunities to invest.

See how the London market has progressed so far this year in our Lettings Market Reports.

If you can navigate the challenges and find the instances of favourable mortgages for your situation, you can provide much-needed lettings supply for London's growing rental demand. That’s why we recommend you speak with the Buy to Let specialists at our partner mortgage advisory firm, Alexander Hall.

How have lenders responded to the challenges of the market?

5-year fixed rates have been incredibly popular over the last decade. With the changing landscape however, more mortgages are being taken on variable rates; partly because some offer a level of flexibility (being able to redeem with no penalties for example), and partly because many of these products have been priced more competitively as the base rate has risen.

We currently see lenders offering trackers at 0.09% above Bank of England base rate. Although now more expensive than some of the fixed rates available, variable or tracker rates pose a potential saving for those who are more optimistic about the direction of interest rates over the remainder of 2023.

Some lenders have adapted their offerings, with lower interest rates and higher fees. This enables lenders to offer more generous levels of lending (lower monthly interest payments means the rent is more likely to cover the cost of the mortgage), whilst also attaining their required margin through the higher product fee charged.

How can Alexander Hall help you?

Alexander Hall can make the difference for your London let:

- Alexander Hall have access to the whole of the intermediary market, meaning clients can choose from the most competitive products to suit their needs.

- Some of the lenders Alexander Hall work with will look at holistic financial circumstances and additional income streams, to potentially increase the available lending for your venture.

- Alexander Hall can also advise you on more diverse property types, for example, Houses of Multiple Occupancy (HMOs), properties in need of refurbishment, and multi-unit freehold blocks (MUBs), with a team of highly experienced advisers specifically deal with portfolio Landlords, bridging, and refurbishment mortgages.

Tales from the road

Here are a few recent Alexander Hall cases, which show what is possible in today's market:

A family with a large portfolio of properties in varying ownership structures (circa £10m) wanted to incorporate their properties into a Limited Company structure off the back of tax advice they'd received. Alexander Hall arranged 24 applications to refinance their properties, including raising additional funds to pay for refurbishment of the properties in preparation for the EPC changes. This tailored solution didn’t require any deposit funds being transferred for the change in ownership, the lender was also flexible in accepting a client age of 77, beyond the conventional limit of 70.

An Alexander Hall client bought a distressed property with an EPC rating of G, which was not mortgage-able. They bought it through their limited company for £430,000, and completed relatively minor works, costing £20,000. Alexander Hall’s Specialist Finance Team arranged bridging finance for the client to complete their purchase. Once the work was complete, Alexander Hall helped them refinance based on the uplifted value of £500,000.

An Alexander Hall client who typically buys small flats in period conversions in Zone 1 decided to buy an ex-local authority flat in Zone 2. It was a 3-bed flat in Battersea for £400,000. It will be let to 3 sharers under one assured shorthold tenancy, and the yield will be c. 9%, which cleanly offsets the higher interest cost (a 5.19% rate).

Each case is unique. Get in touch to learn more about what Alexander Hall can do for your specific situation.

Tailored service for your property portfolio

Our Premier Clients team handle large and expanding portfolios for landlords. Through this team, we can provide even greater access to corporate services. If you own multiple rental properties, get in touch – we can look into providing you a managed portfolio as well.

More insights for London landlords

Renters Reform Bill: everything Landlords need to know now.