You’ve decided to become a homeowner – great choice. Every month, with every mortgage payment, you will secure a stronger investment in London property. But being a homeowner in the Capital is about so much more than savvy investing; London is one of the most desirable places to set down roots.

Want to start your search right? Here is our best insight from our local Sales Managers and trusted partners.

Step one: know what you can do

Beginning a property search can be overwhelming, so start with a plan. Your first call should be to book in an appointment with a mortgage advisor, like our partners Alexander Hall , who can help you figure out your price range.

They will help you analyse all the different aspects of your situation that can affect your mortgage rate, sort through an exclusive range of mortgage products to find the best matches and then guide you through the application so it’s successful.

Getting them involved at this stage means they can prepare you an Agreement in Principle (AIP). They can also tell you, as you're viewing properties, what might affect what a lender would offer.

Also referred to as decision in principle (DIP) or mortgage in principle (MIP), this determines how much you are able to borrow and involves a credit check. It allows you to view properties in your price range with confidence and have the evidence you need when making an offer. This document sets you apart as a serious buyer, so we strongly recommend you start here.

The average amount, if you're buying London property, is around 15% for a deposit. However there are options available with a 5% or 10% deposit. Typically if you have saved a larger deposit, you are likely to get a lower interest rate and smaller monthly repayments.

Wondering how much you can borrow? Start with Alexander Hall's mortgage calculator.

A fixed rate, such as a 2-year or 5-year fixed term, means the rate is secured for that amount of time. This makes it easier to budget as you know your mortgage outgoings will remain the same for that period. These products will often have early repayment charges on, should you wish to clear the debt before the end of the fixed rate period.

Variable-rate mortgages, such as tracker or discount products can change at any time based on the market. So you need to be confident you can afford those monthly payments in the event of a rate increase. Sometimes variable rates offer more flexibility compared to fixed products, but your Advisor will be able to review your circumstances and advice which would suit best.

There is no set mortgage term, but for first-time buyers we often see terms range from 25 to 40 years. The longer the term, the lower the monthly payments, but the greater the interest you'll need to repay over the life of the mortgage.

There are several schemes available for first-time buyers, but we highly recommend you get in touch with a professional. Contact Alexander Hall to discuss your eligibility and, if your chosen scheme requires a new build, contact Foxtons New Homes team to find the right property that is eligible for your scheme.

Deposit Unlock

This allows you to purchase certain new-build properties with just a 5% deposit. New build properties have a range of benefits for first time buyers, including the fact that everything from the appliances to the building itself is brand new so warranties are in place and maintenance is minimal. Also, new-build properties are typically more energy efficient than resale properties, which you can read more about in our article, Could energy efficiency sway buyers towards new-build homes?

First Homes

This is another scheme for new build, or properties that were previously bought as new build properties. It allows you to buy for 30-50% less than a property’s market value.

There are stricter eligibility conditions: you must have a total household income of £90,000 if you live in London, and some councils specify that the home must cost no more than £420,000. You’ll also need to only sell the home through the scheme too, and with the same percentage discount.

Shared Ownership

With shared ownership, you part-buy/part-rent a property. Your total household income must be below £90,000 and you’ll have to be approved by the housing association as well.

Stamp duty savings

According to the latest Foxtons London Report, one in two apartments are sold under the Stamp Duty threshold (£425,000 nil rate), "One in every two apartments now sells with a nil rate, up from just one in four before the change in September."

All first-time buyers will benefit from greater stamp duty savings on their purchase. Read more about it in our article What the stamp duty tax cut means for you, or see your savings through our stamp duty calculator.

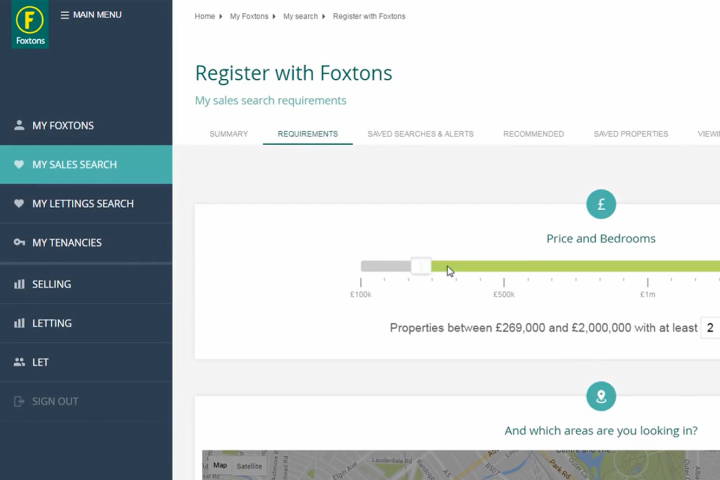

Step two: register your search

It's quick and easy to register your My Foxtons account. Then, put in the details of what you’re looking for and look out for our calls and emails. The Negotiators across our offices can show you properties so you won't need to contact each of our offices individually. Simply set up your account, check in frequently on our new listings and keep in touch with our team.

Step three: start viewing properties

After pouring over a property's pictures online, it can be overwhelming to walk into the actual home, so do your research on the area and come prepared with questions.

You should also be prepared to answer the phone and provide feedback on all the properties you see, even the ones that you didn't choose, because agents will reward you for your diligence by calling you sooner and getting you in to view new properties earlier.

Here's some insight on what to ask at a property viewing.

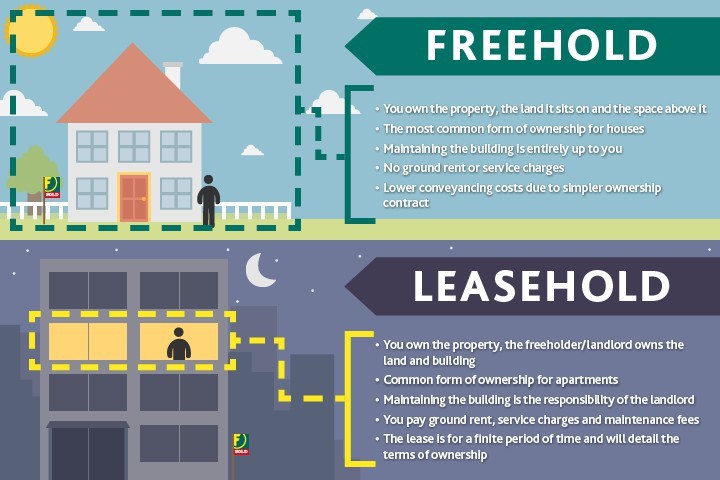

When looking for properties to buy, first-time buyers often ask this question.

The main difference is whether you own the land and the building that your home is on (freehold), or if there is a freeholder/landlord whose responsibility it is to maintain the building (leasehold). If you want to learn more about the pros and cons of leasehold and freehold, and the latest legislation, read our article: Freehold vs Leasehold: the differences and what to consider

Step four: time to make your offer

We actually hear quite often about buyers who've missed their first choice because they saw it early in their search. Our recommendation is to prepare before you start your search, and act quickly when you see something you like. It's always worth it to put in an offer.

From our article on how to make an offer when buying a home, here are a few key points in your offer:

• The offer amount and what led you to it

• Your proposed move-in date

• What work needs to be done

• If you have a mortgage/solicitor in place

• The amount in your deposit

We also recommend you always send the full, complete offer in writing (an email is considered 'in writing') to avoid confusion down the line.

Step five: move in or move on

So you don't want to hold off on making an offer because you found your dream property too soon, but at the same time, don't be discouraged if you aren't successful the first time around. You've learned more about what you're looking for and what to do when you've found it. Get back in touch with a trusted agent and give it another go.

Step six: the follow-through

If your offer is accepted, here's what you can expect to come next:

1. Instruct your solicitor We recommend Conveyan, the panel of independent London property solicitors chosen for their success on Foxtons clients' cases. Like with mortgages, the more pro-active you are in hiring your solicitor, the quicker and more seamless your property transaction.

2. Apply for the mortgage If you've chosen to work with a mortgage broker, like Alexander Hall, they advise what product suits best and manage your mortgage application through to completion.

3. Send the deposit and paperwork through These will go through your solicitor, who will also be receiving paperwork from the seller's solicitor.

4. Exchange contracts The house will only be well-and-truly yours once the contracts are exchanged and the keys are handed over. Congratulations!

Any more questions? Get in touch with your local Foxtons office.