A stamp duty land tax cut has been announced Friday 23 September, effective immediately. Here’s what that means for London homebuyers.

Update: this tax cut is no longer permanent. If you plan to use it, you'll need to complete your property purchase before 31 March 2025.

Stamp Duty is the land tax for homes. Prime Minister Liz Truss and her Chancellor of the Exchequer, Kwasi Kwarteng, announced plans to reduce Stamp Duty earlier in the week, and they were confirmed in the government’s mini-budget today (Friday 23 September), in an effort to grow the economy.

This tax cut can save UK resident homebuyers up to £2,500, and first-time buyers up to £11,250, opening up many new opportunities in the London property market. Chancellor Kwarteng said, “the steps we’ve taken today mean that 200,000 more people will be taken out of paying stamp duty all together.”

How much is the stamp duty tax cut?

Before the announcement, for UK residents, you would pay stamp duty on properties starting at £125,000 and increasing as the value increases. According to the Government Stamp Duty reference page:

| Property Value | Old Stamp Duty Land Tax Rate | New Stamp Duty Land Tax Rate |

|---|---|---|

| Up to £125,000 | 0% | 0% |

| The next 125,000 (the portion from £125,001 to £250,000) | 2% | 0% |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% | 10% |

| The remaining amount (the portion above £1.5 million) | 12% | 12% |

Chancellor Kwarteng has announced that the stamp duty tax nil-rate band has been raised permanently, meaning the price a property can be purchased at without paying stamp duty has doubled to £250,000 – saving you up to £2,500. These stamp duty savings could help you invest in a bigger property, a home with a back garden, or a more optimal location.

Further benefits for first-time buyers

The band rates for first-time buyers have gone up as well. Previously, first-time buyers paid 0% stamp duty on property values up to £300,000. This new announcement has put that nil-rate band up to £425,000. Additionally, first-time buyers, who could previously claim relief on property values up to £500,000, can now claim relief on property values up to £625,000. With these new rules in place, first-time buyers can see savings up to £11,250. This price bracket will allow for some fantastic first home opportunities.

It also coincides with the last stretch of Help To Buy – if first-time buyers want to use this scheme, they have to get their application in by 31 October, 2022. So, if you want to make use of both the new stamp duty rules and Help to Buy, it’s crucial that you get in touch as soon as possible.

The impact on Londoners

To put this stamp duty cut in perspective – we had a stamp duty holiday from early July 2020 to the end of September 2021, and it made a massive impact on the housing market in London. Before the holiday, if you bought a property valued at up to £125,000, you wouldn’t have to pay stamp duty. During the holiday, buyers were not required to pay tax for properties up to £500,000, which saved buyers up to £15,000 and urged many to look in a higher band than they’d normally consider.

- Looking just before Stamp Duty started in June 2020, and the following June when the holiday was in full swing, there were 62% more deals completed in June 2021 across the London house market.

- Looking at January to September 2021, when there was a push to get deals completed before the holiday ended, there were 57% more deals completed across the London house market than the same period in the previous year.

Analysis provided by Foxtons Business Analytics

The significant savings created a powerful incentive and put higher-value properties within reach for many homebuyers. This new stamp duty cut has been proposed with the same intention. London’s residents could make a savvy investment for their future with a higher value home.

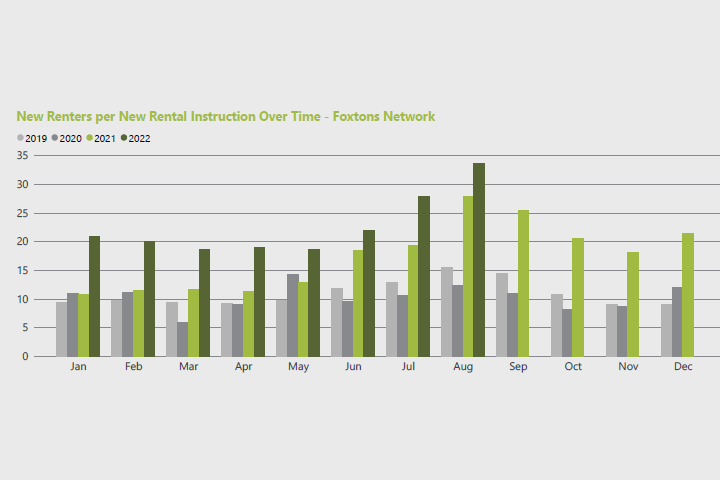

There is also a benefit for any London landlords with goals to expand their portfolios. So far this year, new rental listings in the London market have been 39% lower than in 2021. There is a huge lack of rental property supply. Our latest Lettings Market Report states, “August 2022 became the highest ever month recorded for applicant registrations.” Sarah Tonkinson, Foxtons Managing Director of Institutional PRS and Build to Rent, said, “with this year’s lack of new rental stock and with demand breaking records, we’re headed into a Q4 that could be unprecedented in its renter demand.” So, considering the news of a stamp duty cut, landlords could expand their portfolios and make use of the exceptionally high rental demand, providing greater supply of London properties to let.

Get in touch

If you’ve been waiting for a change in the market, if you’re a landlord considering opportunities for your portfolio, or if you’ve been considering making a move, now is your chance. Get in touch, and we’ll help you make the most of the stamp duty cut. Find your local Foxtons office here, or get in touch through your My Foxtons account, or get in touch with the team at Alexander Hall to have your stamp duty questions answered and make the most of the changes.