Foxtons London Report - Autumn Statement found that it’s still a good time to buy your first home in London.

A silver lining for homebuyers

There remains a relationship between demand in the rental market and demand from first-time buyers, as many look between the two markets to decide whether they’d prefer the flexibility of renting or the security of buying.

The London rental market has been very tight in recent years with limited supply and changing policy putting upward pressure on rent prices, and this has convinced a fair few to leave the rental market and take their first steps onto the property ladder.

If you’re considering buying your first home and have enough of a deposit to make it happen, we have good news. Our Autumn Statement found that it is currently cheaper to buy a home then rent one, where the mortgage is concerned.

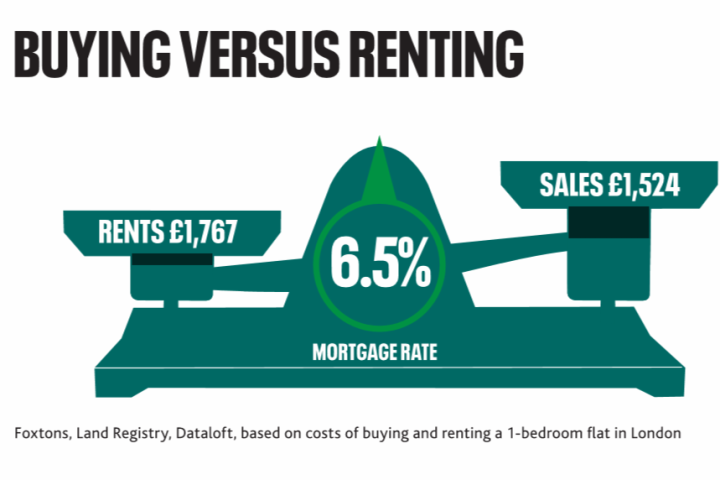

The mortgage story: The Bank of England’s decision to raise the base rate to combat inflation has caused mortgage rates to increase in 2023. There has been a lot of attention on mortgage rates 2023, and within the last month, we have all been relieved to see pressure ease on mortgage rates. However, our research shows there still was a more room for rates to rise before it’d be cheaper to rent.

Looking at the average price of a one-bed London flat in the 2023 (£352,254) the mortgage payment would be £1,524. Average rent payments for a one-bed London flat would be £1,767.

Getting it right the first time

The big difference between the price to rent and the price to buy is that initial hurdle for buyers. This, obviously, includes the big upfront cost in the deposit. Besides that, you have to budget for stamp duty, solicitors’ fees, costs in obtaining a mortgage, surveyor fees, moving fees and the lot.

💡 The initial costs are why, if you’re buying, you should prepare as much as possible before you reach the paperwork stage (which comes after your offer is accepted):

• Instruct your solicitor early and ensure you’ve got all the paperwork before your solicitor needs to submit it.

• Getting a mortgage advisor involved before you make an offer means you (and the seller) will know that you can afford what you’re offering. A mortgage advisor can also ensure your application goes smoothly and quickly.

You don’t want to get bogged down during the paperwork stage simply because you weren’t prepared, as delays at this stage could affect the success of your purchase and going through the buying process multiple times can really eat into your budget.

Plan for success with our Buyer Checklist.

Starting your search? If you're thinking about buying a home in London, now is a good time to start your search. We have excellent homes for first-time buyers all over the capital, and if you register your search on My Foxtons, you’ll get to jump the queue for our newest listings.

Photos: Learn more about the exceptional lifestyle benefits you see here at Coppermaker Square, or get in touch with our Build to Rent team, who'd be more than happy to show you around.

A focus on value in the rental market

This is not to say there aren’t good deals to be had in the rental market - sometimes it takes a little patience and persistence to find the right let. At the same time, price isn't the only factor in choosing whether to buy or rent your next home. There is an increasing level of professionalism in the lettings market which some Londoners prefer to buying. For instance, we work with Build to Rent developers who have designed and built entire developments around crafting the perfect resident experience.

These developers factor additional benefits into their offering, like the security of a concierge, the ease of a maintenance staff, the comfort of built-in community, money-saving amenities like a gym or co-working space, free WiFi across the building, excellent transport bringing the opportunities of the capital in reach, etc. So, Build to Rent residents can ensure they’re getting the best value out of the money they pay in rent.

Get in touch with our Build to Rent team to learn more about developments in your search area.